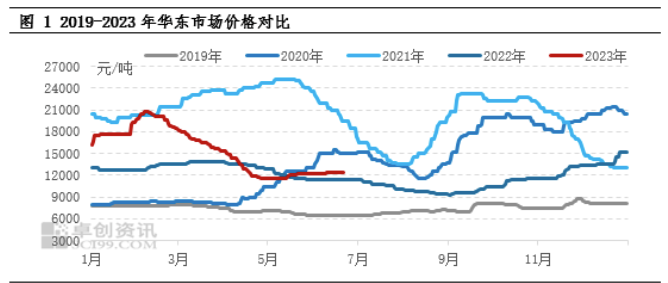

Od roku 2023 trh s MIBK zaznamenal výrazné výkyvy. Napríklad trhová cena vo východnej Číne má amplitúdu maxima a minima 81,03 %. Hlavným ovplyvňujúcim faktorom je, že spoločnosť Zhenjiang Li Changrong High Performance Materials Co., Ltd. ukončila prevádzku zariadení MIBK koncom decembra 2022, čo viedlo k sérii zmien na trhu. V druhej polovici roka 2023 sa domáca výrobná kapacita MIBK bude naďalej rozširovať a očakáva sa, že trh s MIBK bude čeliť tlaku.

Prehľad cien a logická analýza, ktorá sa za ním skrýva

Počas rastúcej fázy (21. decembra 2022 až 7. februára 2023) sa ceny zvýšili o 53,31 %. Hlavným dôvodom rýchleho nárastu cien sú správy o parkovaní zariadení spoločnosti Li Changrong v Zhenjiangu. Z absolútnej hodnoty výrobnej kapacity má spoločnosť Zhenjiang Li Changrong najväčšiu výrobnú kapacitu zariadení v Číne, ktorá predstavuje 38 %. Odstavenie zariadení spoločnosti Li Changrong vyvolalo medzi účastníkmi trhu obavy z budúceho nedostatku dodávok. Preto aktívne hľadajú doplnkové dodávky a trhové ceny jednostranne výrazne vzrástli.

Počas fázy poklesu (8. februára až 27. apríla 2023) ceny klesli o 44,1 %. Hlavným dôvodom neustáleho poklesu cien je nižšia terminálová spotreba, ako sa očakávalo. S uvoľnením niektorých nových výrobných kapacít a zvýšením objemu dovozu sa postupne zvyšuje tlak na zásoby v spoločnosti, čo vedie k nestabilnej mentalite účastníkov trhu. Preto aktívne predávali svoj tovar a trhové ceny naďalej klesali.

Keďže cena MIBK klesla na nižšiu úroveň (28. apríla až 21. júna 2023), údržba viacerých súprav zariadení v Číne sa zvýšila. V druhej polovici mája boli zásoby výrobných podnikov kontrolovateľné a vyššie uvedená cenová ponuka zvýšila objem dodávok. Počiatočné zaťaženie hlavného downstreamového antioxidačného priemyslu však nie je vysoké a celkové očakávania rastu sú opatrné. Až do začiatku júna, v dôsledku zverejnenia nových plánov výrobnej kapacity, skoré kvantitatívne obstarávanie downstreamového ťažobného priemyslu podporovalo zvýšenie zamerania na transakcie, oproti 6,89 % v prvej polovici roka.

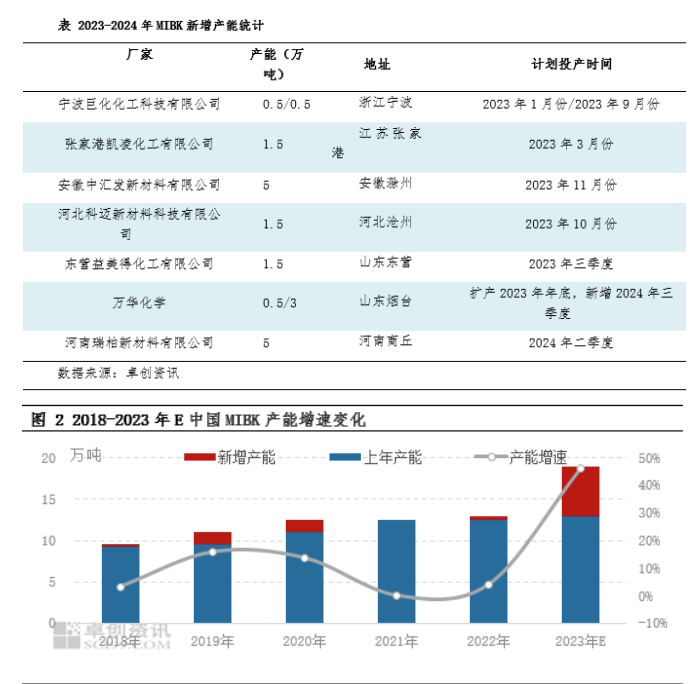

Výrobná kapacita sa bude v druhej polovici roka naďalej rozširovať a zmení sa aj štruktúra dodávok.

V roku 2023 Čína vyrobí 110 000 ton novej výrobnej kapacity MIBK. Bez započítania parkovacej kapacity Li Changrong sa očakáva, že výrobná kapacita sa medziročne zvýši o 46 %. V prvom štvrťroku 2023 boli medzi nimi dva nové výrobné podniky, Juhua a Kailing, ktoré pridali výrobnú kapacitu o 20 000 ton. V druhej polovici roka 2023 plánuje China MIBK uviesť na trh 90 000 ton novej výrobnej kapacity, a to Zhonghuifa a Kemai. Okrem toho dokončila aj rozšírenie Juhua a Yide. Očakáva sa, že do konca roka 2023 dosiahne domáca výrobná kapacita MIBK 190 000 ton, z čoho väčšina bude uvedená do výroby v štvrtom štvrťroku, a postupne sa môže prejaviť tlak na dodávky.

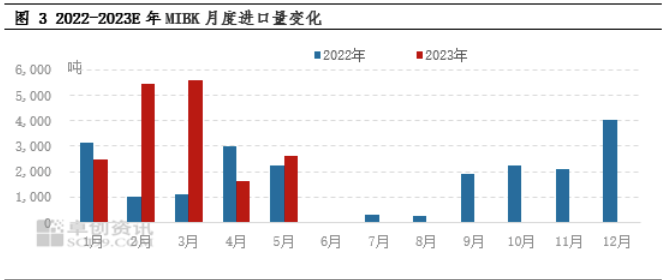

Podľa colných štatistík doviezla čínska spoločnosť MIBK od januára do mája 2023 celkovo 17 800 ton, čo predstavuje medziročný nárast o 68,64 %. Hlavným dôvodom je, že mesačný objem dovozu vo februári a marci prekročil 5 000 ton. Hlavným dôvodom je parkovanie zariadení spoločnosti Li Changrong v Zhenjiangu, čo viedlo k tomu, že sprostredkovatelia a niektorí následní zákazníci aktívne hľadali dovozné zdroje na doplnenie, čo viedlo k výraznému nárastu objemu dovozu. V neskoršej fáze je v dôsledku slabého domáceho dopytu a kolísania výmenného kurzu RMB cenový rozdiel medzi domácim a zahraničným trhom relatívne malý. Vzhľadom na expanziu spoločnosti MIBK v Číne sa očakáva, že objem dovozu sa v druhej polovici roka výrazne zníži.

Celková analýza naznačuje, že v prvej polovici roka 2023, hoci Čína uviedla na trh dve nové výrobné kapacity, rast produkcie po investíciách do nových výrobných kapacít nedokázal držať krok so stratou produkcie po odstavení zariadení spoločnosti Li Changrong. Domáca medzera v ponuke sa spolieha najmä na doplnenie dovážaných dodávok. V druhej polovici roka 2023 sa domáce zariadenia MIBK budú naďalej rozširovať a cenový trend MIBK sa v neskoršej fáze zameria na postup výroby nových zariadení. Celkovo sa ponuka na trhu v treťom štvrťroku nedá úplne doplniť. Podľa analýzy sa očakáva, že trh MIBK sa konsoliduje v rámci rozpätia a po koncentrovanom raste v štvrtom štvrťroku budú trhové ceny čeliť tlaku. Počas rastúcej fázy (21. decembra 2022 až 7. februára 2023) sa ceny zvýšili o 53,31 %. Hlavným dôvodom rýchleho nárastu cien sú správy o parkovaní zariadení spoločnosti Li Changrong v Zhenjiangu. Z absolútnej hodnoty výrobnej kapacity má spoločnosť Zhenjiang Li Changrong najväčšiu výrobnú kapacitu v Číne, čo predstavuje 38 %. Odstavenie zariadení spoločnosti Li Changrong vyvolalo medzi účastníkmi trhu obavy z budúceho nedostatku dodávok. Preto aktívne hľadajú doplnkové dodávky a trhové ceny jednostranne výrazne vzrástli.

Čas uverejnenia: 27. júna 2023